- Details

- Category: Press Releases

CENTREVILLE – State Senator Christopher Belt (D-Centreville) was joined by State Senator Mattie Hunter (D-Chicago), the sponsor of the law, to celebrate the signing of the fourth and final pillar of the Legislative Black Caucus’ plan to eradicate systemic racism.

“Over the past year, Illinois has lost thousands of people, and the country has lost millions to COVID-19. When this pandemic became the focus of the nation, so did the realities of systemic racism in our health care systems,” Belt said. “The inequities that exist were made more apparent than ever before. We’re no longer waiting to address issues that are leading to the unnecessary deaths of thousands of Black Illinoisans.”

The law addresses numerous issues in Illinois’ health care and human services sectors, including health care accessibility, infant mortality, hospital reform, mental health and substance abuse treatment, and medical implicit bias.

One substantial provision would halt hospital closures for up to 60 days to ensure underserved communities retain access to emergency care during the pandemic. Other provisions include establishing a Medicaid MCO Commission to evaluate Illinois’ managed care program and requiring the state to facilitate partnerships between Federally Qualified Health Centers and hospitals.

“For centuries, Black people have been disrespected, abused and misused in the health care system. This system that binds and neglects Black people binds and neglects others, and must be grasped at the root,” Hunter said. “It was our goal with this legislation that no one will be mistreated or prejudged by the ones providing them with medical assistance. I am grateful to live in a time where we can rectify the wrongs of our past and begin a new chapter in American history where Black people and other groups will cease to be marginalized.”

“The signing of this legislation only reflects the beginning of what will be a long and difficult road to achieving true equity in our health care system,” Belt said. “I’d like to thank Senator Hunter for joining us today and sponsoring this vital legislation.”

House Bill 158 was signed on Tuesday and took effect immediately.

- Details

- Category: Press Releases

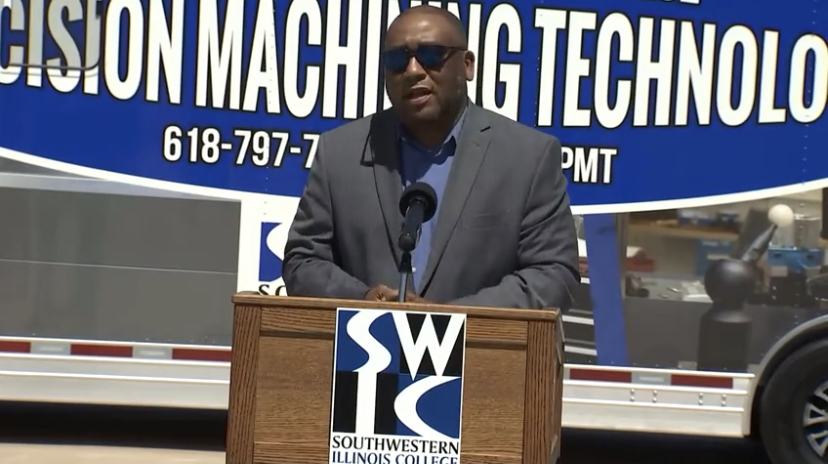

BELLEVILLE – State Senator Christopher Belt (D-Centreville) was joined by Governor JB Pritzker on Friday to announce a $7.5 million investment from the Illinois Department of Commerce and Economic Opportunity to build an advanced manufacturing training academy on Southwestern Illinois College’s Belleville campus to help train Illinoisans for new manufacturing jobs.

“I’m thrilled that SWIC was chosen for this project,” Belt said. “This equity-based program will provide residents with opportunities to develop specialized skills for careers in manufacturing.”

The funding will be used to create a new manufacturing training center on SWIC’s Belleville campus with new computers and other specialized equipment to prepare local residents for careers in electricity and welding.

“One of Southwestern Illinois College's primary goals is to train students for well-paying, highly skilled, in-demand career fields, and the construction of a manufacturing training academy will bolster these efforts," said SWIC President Nick Mance. "In light of the unemployment rate and economic distress in the area, it is more crucial than ever that students embark on a viable career pathway that leads directly to steady employment paying a living wage or better."

The program will also help address equity gaps in the region, creating a diverse recruitment program to ensure more minority and women students can participate in the training, bringing the right skills for 21st century manufacturing directly into downstate communities.

“Manufacturing is an important industry in our state,” Belt said. “We need to train the workforce for these vital jobs.”

The Advanced Manufacturing Center will break ground in 2021 and is expected to be ready for students by the fall of 2022.

Visit DCEO’s website for more information on the Manufacturing Training Academies programs.

- Details

- Category: Press Releases

SPRINGFIELD – A measure sponsored by State Senator Christopher Belt (D-Centreville) that would allow most major Illinois airports to directly receive and spend federal funding passed the State Senate on Thursday.

The measure would allow Illinois airports that have 10,000 or more patrons per year to directly receive and spend federal funding. Under the current law, federal funding goes to the Illinois Department of Transportation’s aeronautics division to distribute to airports across the state, with the exception of O’Hare and Midway International Airports in Chicago.

“This measure will give most major airports in Illinois the authority to make their own financial decisions,” Belt said. “It will reduce unnecessary work at IDOT and help reduce the backlog on airport improvement projects.”

Currently, IDOT must approve all planning, construction, development and improvements to hangars. The approval process for these contracts is backlogged, and this measure would take the pressure off of IDOT and allow individual airports to move forward with projects on their own timelines.

“Larger airports in this state have the staff and resources necessary to manage their own funding,” Belt said. “Allowing larger airports to make their own decisions will speed up the approval process for our smaller airports as well, benefitting airports of all sizes.”

Senate Bill 1232 passed the Illinois Senate with a vote of 52-1 and now heads to the Illinois House of Representatives for further consideration.

- Details

- Category: Press Releases

SPRINGFIELD – An initiative sponsored by State Senator Christopher Belt (D-Centreville) that would ensure all eligible employees are paid prevailing wage and create a more transparent Illinois Department of Labor passed the State Senate on Thursday.

The Prevailing Wage Act requires contractors and subcontractors to pay laborers, workers and mechanics employed on public works construction projects no less than the average rate for the same work in the county where the work takes place.

The initiative would require IDOL’s electronic database of payroll records to be listed by the middle of each month and searchable by the public, ensuring compliance with prevailing wage laws.

“The government shouldn’t be involved in underpaying construction workers,” Belt said. “We owe it to the public to generate good paying jobs and guarantee government construction projects are done the right way.”

Though IDOL is already required to maintain a database of payroll records to ensure workers are actually being paid the prevailing wage, Belt’s legislation would make it public.

“This added transparency would help make sure these employees are receiving the wage they deserve,” Belt said.

Senate Bill 1767 passed the Illinois Senate with a vote of 42-11 and will now head to the Illinois House of Representatives for further consideration.

More Articles …

Page 68 of 104